As a reminder, since 1 January 2022, the ‘Company Vehicle Tax’ (TVS) has been repealed and replaced by the ‘Tax on the allocation of vehicles tourism for economic purposes’, which itself consists of two annual taxes :

- The CO2 emissions tax

- The tax on vehicle age

Then, as of 1 January 2024, the ‘tax on vehicle age’ was replaced by the ‘tax on air pollutant emissions’, the calculation of which has been fundamentally changed and its rate significantly increased.

We would like to remind you of the obligations associated with this tax.

Since Law No. 2016-1827 of 23 December 2016 on social security financing for 2017, the following remain unchanged :

- The tax period, which remains the calendar year;

- The reporting procedures, which depend on the VAT status of the liable company.

Taxable companies

The scope of these two taxes is broader than that of the TVS, which only applied to companies and similar legal entities.

From now on, both taxes on the use of passenger vehicles for economic purposes are payable by the company using the vehicle, regardless of its legal status. This means that sole traders, who were not previously subject to the TVS, are now affected by both taxes.

However, certain exemptions compensate for this extension of the scope of application. Vehicles used by individuals operating under their own name, by certain non-profit organisations, or for certain activities, are exempt from these taxes.

Taxable vehicles

The vehicles concerned remain those registered in the ‘private car’ category with the letters VP on the registration certificate or J1 on the new ‘European’ vehicle registration document, as well as those registered in the ‘N1’ category and intended for passenger transport (vehicles whose vehicle registration document bears the words ‘Camionnette’ or ‘BB’ but which have several rows of seats). Vehicles with at least five seats and whose vehicle registration document bears the words “camionnette” or ‘BE’ are taxable, or ‘BB’ but which have several rows of seats). Vehicles with at least five seats and whose registration document bears the words ‘pick-up lorries’ or ‘BE’ are taxable.

Exempt vehicles

- Vehicles intended exclusively for sale or hire, if they are used solely for the purposes of their construction, marketing, repair or technical inspection and are used only for economic purposes;

- Vehicles accessible to wheelchair users with a maximum of eight seats in addition to the driver’s seat;

- Vehicles rented for a period of no more than one calendar month or thirty consecutive days;

- Vehicles used for agricultural or forestry activities;

- Vehicles used for economic purposes by a natural person carrying out their professional activity in their own name (CIBS Art. L 421-127 and L421-139), it being specified that the benefit of this exemption is subject to compliance with the regulations relating to de minimis aid.

Tax calculation and rates

The amount of tax is calculated by applying a rate that takes into account the annual proportion of use of the vehicle.

The annual proportion of use is in principle equal to the following quotient :

- Numerator : the duration of use of the vehicle, in days;

- Denominator : the number of days in the calendar year.

The amount of tax due for each vehicle is equal to the sum of the two taxes :

- CO2 emissions tax;

- Air pollutant emissions tax.

First tax : Tax on CO2 emissions

The tax rate has changed since 1 January 2024.

Since that date, the scale combines a marginal rate for each CO2 emission bracket, which is being gradually reduced by 5 grams per kilometre until 2027.

This initial tax applies to :

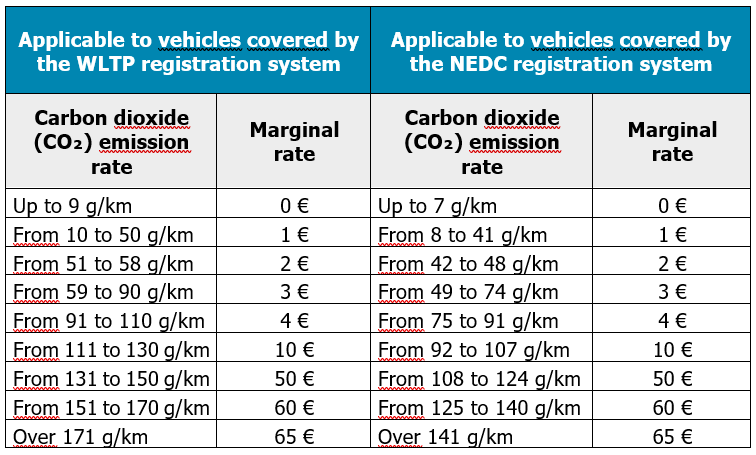

- Vehicles covered by the new registration system (WLTP) :

- Vehicles first registered in France from March 2020 onwards

- Vehicles that cumulatively meet the following criteria (NEDC) :

- Used or owned by the company since 1 January 2006;

- First registered since 1 June 2004;

- Subject to EC type-approval within the meaning of Directive 2007/46/EC

Tariff based on CO₂ emissions for the year 2025

It should be noted that since 1 January 2025, a tax reduction has been applied to vehicles that run exclusively or partially on E85 superethanol, under the following conditions :

- 40% of CO2 emissions, except when these exceed 250 g/km;

- 2 HP for fiscal power, except when this exceeds 12 HP.

In addition, vehicles powered exclusively by hydrogen, electricity or a combination of the two are exempt from annual CO2 tax.

Finally, as of 1 January 2025, hybrid vehicles will no longer be exempt from this annual CO2 emissions tax.

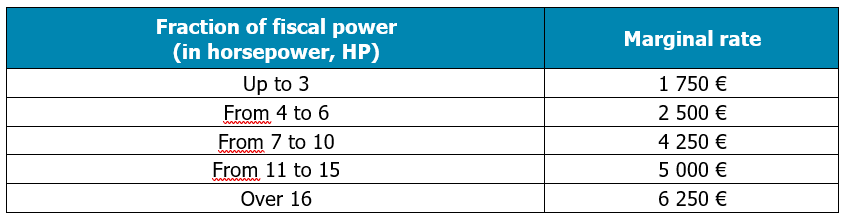

For vehicles that do not fall into the two previous categories, the tax rate is set according to the administrative power. These are vehicles :

- Owned or used by the company before 2006;

- Owned or used since 1 January 2006 and first registered before June 2004;

- Subject to national (or individual) type approval : vehicles imported from another market for which CO₂ emissions data is unavailable, for example.

Rate based on fiscal power for 2025

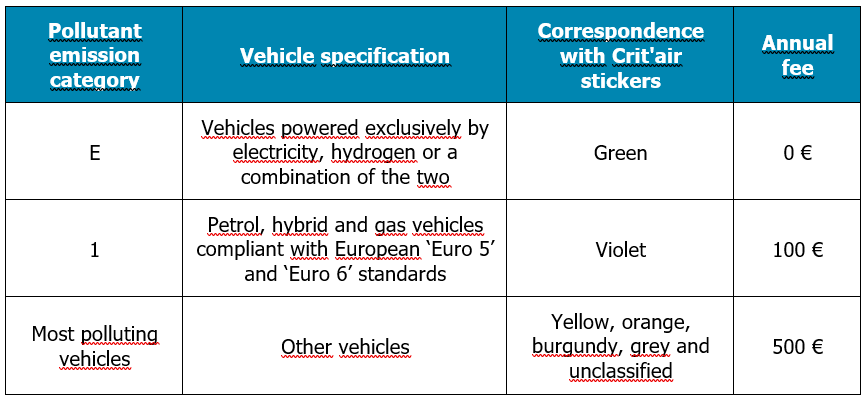

Second tax : Tax on atmospheric pollutant emissions

The rate of this new tax varies according to the category of pollutant emissions to which the vehicle belongs : (See box V.9 on the vehicle registration document)

Tariff based on pollutant emissions for the year 2025

As of 1 January 2025, there will no longer be any exemption from this second tax for all hybrid vehicles.

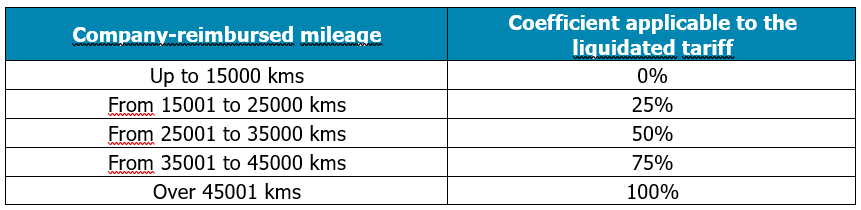

Weighting coefficient

For vehicles owned or leased by employees or executives who are eligible for mileage reimbursement :

- A percentage coefficient is applied to the standard rate based on the number of kilometres reimbursed by the company to each employee or executive;

- A deduction of €15,000 is applied to the total amount of tax due on all vehicles owned or leased by employees or executives.

Declaration and payment of ‘Taxes on the use of passenger vehicles for economic purposes’

As with TVS, these returns must be filed and paid online as follows :

- For taxpayers subject to the standard VAT taxation regime: on Appendix No. 3310 A-SD to the VAT return filed in January 2026, namely :

- Line 4323 (117) : the amount of tax on carbon dioxide emissions

- Line 4313 (118) : the amount of tax on the age of passenger vehicles

- For companies not liable for VAT: on Appendix No. 3310 A-SD, to be filed no later than 25 January 2026.

- For taxpayers subject to a simplified taxation regime : on Form No. 3517, which must be filed for the financial year in which the tax became payable.

If your company falls under one of the above categories and if the Firm is responsible for preparing this statement as part of our assignment, we would be grateful if you could send us the table attached hereto and a photocopy of the vehicle registration document(s) by 12 January 2026 at the latest.

Please note that if we do not receive a response from you by this date, we will assume that your company does not use this type of vehicle and does not reimburse mileage allowances to employees or managers, or that it prepares the declaration itself (in which case, please send us a photocopy).

This article was written by RUFF & ASSOCIÉS in December 2025. Please note that this analysis is applicable as of today and does not take into account any changes that may occur; the data is subject to change.

Circular written by Muriel LENCHANTIN – Senior Head of Mission at RUFF & ASSOCIÉS